Assessing your financial position begins with listing all assets and subtracting outstanding liabilities. Assets include cash, investments, property, and any valuables that hold monetary value. Liabilities cover debts such as loans, credit card balances, and mortgages. The resulting figure reveals your actual equity at a glance.

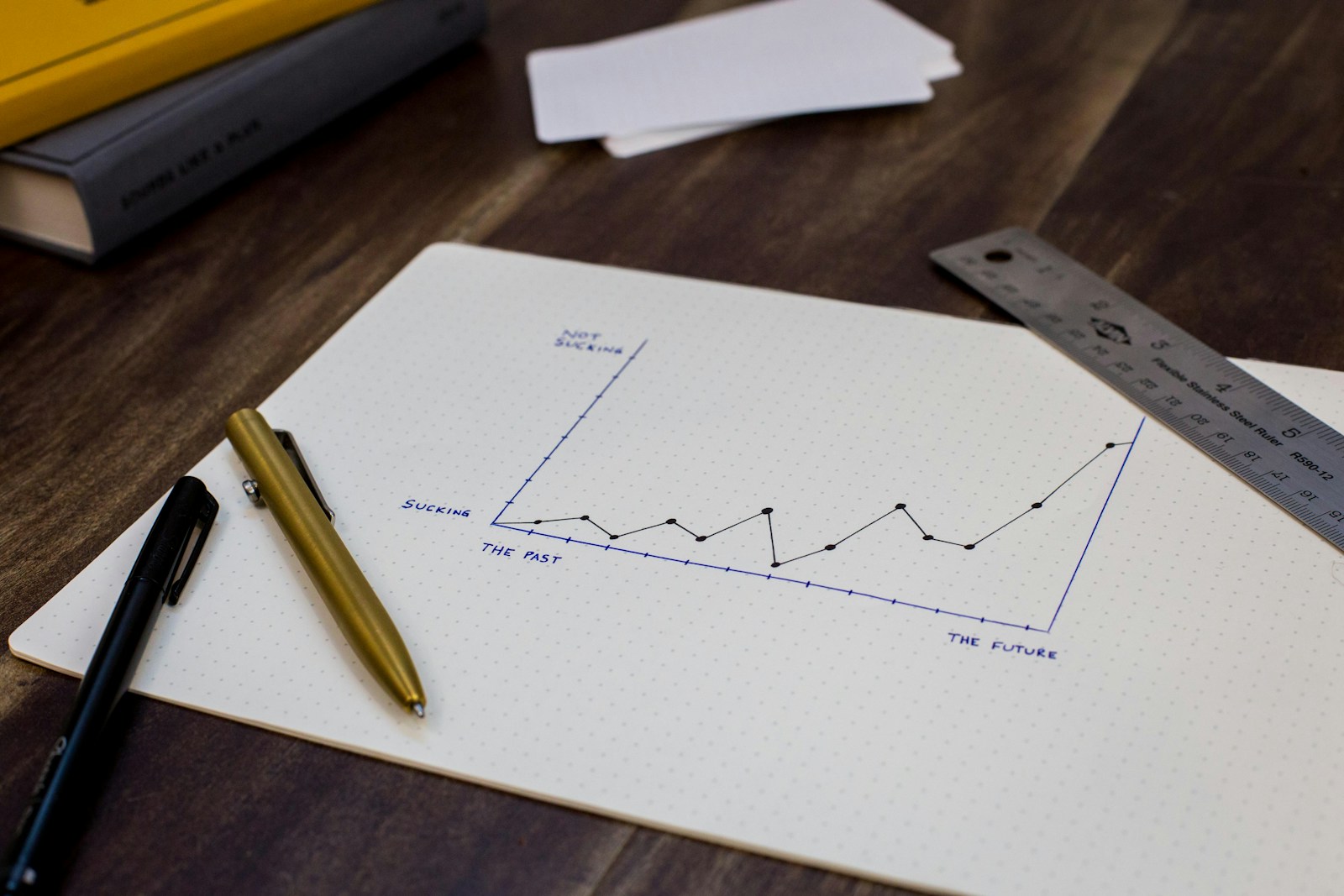

To track advancement effectively, update this figure regularly–monthly or quarterly–to see how changes in spending, saving, or investing affect your overall economic health. For example, increasing asset values or paying down debt will improve your balance, signaling positive development.

Using spreadsheets or dedicated apps simplifies this process by organizing entries and automating calculations. This approach also highlights areas needing attention–like high-interest liabilities–that may hinder growth. Keeping a clear record empowers informed decisions toward building stronger financial foundations over time.

Net value assessment: tracking monetary development

To accurately determine your financial standing, begin by listing all owned assets and outstanding liabilities. Assets include tangible items like real estate, vehicles, and cash reserves, as well as intangible holdings such as investments in stocks or cryptocurrencies. Liabilities cover debts like mortgages, loans, credit card balances, and other financial obligations. The difference between total assets and liabilities represents your equity in monetary terms.

The process of quantifying this balance is crucial for evaluating monetary advancement over time. Consistent assessments enable individuals to identify trends in wealth accumulation or depletion. For instance, a rise in investment portfolio value combined with a reduction in personal debt indicates positive fiscal momentum. Tracking these changes quarterly or annually provides actionable insights for adjusting saving habits or expenditure patterns.

Detailed approach to asset and liability recognition

Precision in itemizing assets enhances the reliability of your financial status report. Beyond conventional accounts, include digital asset holdings such as Bitcoin or Ethereum wallets, valuing them at current market prices due to their volatility. Similarly, liabilities must encompass pending tax payments or unpaid bills that could impact liquidity.

- Assets examples: Checking/savings accounts, retirement funds (401(k), IRA), property ownership documents, cryptocurrency wallets.

- Liabilities examples: Credit card debt statements, outstanding loan agreements, mortgage balances.

A practical case study involves an individual holding $50,000 in various cryptocurrency assets while carrying $20,000 in credit card debt and $100,000 mortgage liability. Their net evaluation would be calculated as $50,000 minus total liabilities ($120,000), resulting in a negative figure of -$70,000 – indicating a need for strategic financial planning to improve overall status.

Applying software tools designed for comprehensive fiscal tracking can ease this calculation process. Many platforms automatically sync bank accounts and investment portfolios to provide real-time snapshots of one’s equity position. Some even incorporate forecasting models based on historical data trends to project future financial outcomes under different scenarios.

Regularly revisiting this balance sheet encourages disciplined money management by highlighting areas requiring attention–such as high-interest debts or underperforming assets–and promotes informed decision-making. By understanding how asset growth compares against increasing liabilities over time, users develop confidence in steering their economic trajectories towards stability and growth.

Identify and List Assets

To determine your overall financial standing accurately, begin by cataloging all possessions that hold tangible or intangible value. These include physical properties such as real estate, vehicles, and valuable collectibles, as well as intangible assets like stocks, bonds, cryptocurrencies, and intellectual property. Each asset should be assigned a current market value based on verifiable data sources such as recent appraisals, exchange rates, or official valuations.

It is equally important to distinguish between liquid and illiquid holdings. Liquid assets–cash, savings accounts, and widely traded securities–can be converted into cash quickly with minimal price impact. Illiquid assets might require more time to sell or may have fluctuating prices; for instance, private equity investments or certain digital tokens may lack frequent trading activity. Accurately listing these items ensures clarity in assessing one’s comprehensive financial health.

Detailed Asset Categorization

Real estate: Use recent sale comparables or professional appraisals to estimate property values. Adjust figures for any mortgages or liens recorded against the property to avoid overestimating ownership interest.

Investment portfolios: Include publicly traded stocks at closing prices on the valuation date. For cryptocurrency holdings, utilize data from reputable exchanges reflecting the token price at a specific timestamp to maintain consistency.

Cryptocurrency wallets must be inventoried carefully; list each coin type along with quantity and current exchange rate in fiat currency equivalents. Remember that some tokens may have limited liquidity or regulatory restrictions affecting their realizable value.

- Cash & Equivalents: Bank balances, money market funds

- Tangible Personal Property: Vehicles, equipment, collectibles

- Retirement Accounts: Pension plans, IRAs valued at the latest statement balances

- Business Interests: Ownership stakes in private companies assessed via earnings multiples or book value

Avoid overlooking liabilities connected to these holdings during assessment. Outstanding debts such as loans secured against assets reduce effective ownership value significantly. For example, if a property valued at $500,000 carries a mortgage of $300,000, only $200,000 contributes positively toward your financial position.

This systematic approach enables precise tracking of economic advancement by juxtaposing asset totals against obligations owed. Regularly updating this inventory reflects changes caused by market fluctuations or personal transactions and supports informed decision-making regarding resource allocation and risk management.

Calculate Liabilities Accurately

Accurate identification and accounting of liabilities is fundamental to understanding one’s overall financial position. This requires listing all outstanding debts, such as loans, credit card balances, mortgages, and any deferred payments that impact your obligations. For example, in cryptocurrency portfolios, liabilities could include margin loans or borrowed tokens used for yield farming. Ensuring these are recorded precisely avoids inflating your asset-based calculations and provides a clear picture of your actual financial standing.

To refine this process, categorize liabilities by their due dates: short-term (due within a year) and long-term (beyond one year). This classification helps prioritize repayments and evaluate liquidity risks more effectively. For instance, if you hold a loan that matures next month but also possess illiquid assets like staked cryptocurrencies locked for months, this mismatch affects your ability to settle immediate debts. Maintaining an updated ledger or using specialized portfolio trackers can support consistent monitoring of such time-sensitive commitments.

Practical Steps for Precise Liability Tracking

A structured approach involves compiling data from multiple sources: bank statements, loan agreements, credit card reports, and blockchain transaction histories. In decentralized finance (DeFi), smart contracts may create implicit liabilities not immediately evident without thorough on-chain analysis. Tools like Etherscan or DeFi Pulse assist in uncovering hidden debt positions linked to collateralized borrowing or flash loans. Cross-referencing these records ensures no obligation remains unaccounted for during asset-liability reconciliation.

The calculation accuracy improves when liabilities are adjusted for currency fluctuations in multi-asset portfolios. Suppose you owe stablecoin-denominated debt but hold assets primarily in volatile cryptocurrencies; converting debts into a consistent valuation metric protects against misleading impressions caused by market swings. Regularly updating the monetary value of both debts and holdings strengthens the reliability of net evaluations and supports informed decisions about optimizing asset allocation or liability reduction strategies.

Use tools for tracking

To maintain an accurate overview of one’s monetary position, employing specialized software and platforms designed for managing assets and liabilities is indispensable. These tools automatically aggregate data from multiple sources such as bank accounts, investment portfolios, cryptocurrency wallets, and debt obligations, enabling precise computation of total equity. For instance, applications like Personal Capital or CoinTracker provide seamless integration with various financial institutions and blockchain networks, updating values in real time.

Automated systems reduce human error in assessing the sum of owned resources versus outstanding debts. By continuously updating figures related to holdings and borrowings, users receive current insights into their economic standing without manual entry. This dynamic monitoring supports better decision-making by highlighting fluctuations in asset values or increases in liabilities that may affect overall fiscal health.

Several platforms offer detailed breakdowns by category or type of holding. Take for example a blockchain portfolio manager: it can segregate tokens according to market capitalization, liquidity, or risk profile while also accounting for loans taken against crypto collateral. This granularity enhances understanding beyond mere totals by illustrating where value concentrates and which obligations carry higher priority.

Incorporating tools with features like scenario modeling helps visualize the impact of potential transactions on net equity. Users might simulate selling part of their stock holdings or repaying certain debts to observe shifts in ownership balance before executing changes. Such predictive functionality is especially valuable when handling volatile assets like cryptocurrencies whose prices fluctuate rapidly.

Tracking instruments often include alerts triggered by thresholds set by the user–such as when liabilities exceed a certain proportion relative to assets–prompting timely reviews or corrective measures. For example, a sudden drop in token valuation could increase leverage risks if borrowed funds remain constant; instant notification allows prompt adjustment strategies to mitigate exposure.

Finally, transparency achieved through detailed reports generated by these utilities supports clearer communication with advisors or stakeholders involved in wealth management. These summaries can incorporate charts illustrating trends over time and tables listing individual components contributing to total economic status. Thus, applying robust tracking solutions not only improves ongoing evaluation but also facilitates comprehensive understanding across all parties engaged in asset stewardship.

Conclusion: Evaluating Changes in Financial Standing Through Asset and Liability Dynamics

Accurately assessing shifts in personal or institutional financial standing requires a detailed examination of both holdings and obligations. The formula balancing total assets against outstanding debts reveals true economic position, enabling individuals and organizations to track growth or decline with precision.

For example, incorporating volatile cryptocurrency portfolios alongside traditional investments demands advanced tracking tools capable of real-time updates. Such integration highlights the importance of dynamic ledger systems that capture both liquid and illiquid asset fluctuations as well as evolving liabilities like loans or smart contract obligations.

Key Insights and Future Directions

- Dynamic Asset Valuation: Employing decentralized price oracles enhances accuracy in reflecting current asset values, crucial for portfolios containing cryptocurrencies with rapid price movements.

- Liability Management Automation: Smart contracts can automate debt servicing schedules, providing transparent records that directly influence net position calculations without manual reconciliation.

- Multi-Source Data Aggregation: Combining on-chain data with off-chain financial statements improves completeness of assessment, mitigating blind spots caused by isolated data sets.

- Predictive Analytics Integration: Leveraging machine learning models can forecast future shifts by analyzing historical patterns in asset appreciation or liability accrual, facilitating proactive strategy adjustments.

The broader impact lies in fostering more informed decision-making frameworks where stakeholders can quantify wealth evolution with granularity previously unattainable. As blockchain ecosystems mature, enhanced interoperability between diverse financial instruments will streamline comprehensive evaluations, helping users maintain clarity over their economic footprint despite complexity growth.

This progression encourages widespread adoption of transparent methodologies that not only measure but anticipate changes in fiscal standing. Ultimately, advancing these capabilities will empower all participants–from individual investors to large institutions–to navigate their monetary realities with confidence and strategic foresight.