The foundation of wallet security in a digital age

In the realm of cryptocurrency, wallets serve as the critical guardians of digital wealth, evolving rapidly to counter an array of sophisticated threats. These tools are not mere storage units but complex systems designed to protect private keys that grant access to blockchain-based assets. As the crypto landscape matures, understanding the foundational elements of wallet security becomes essential for anyone venturing into this space. For those seeking reliable options, platforms like PayPilot’s wallet offer a starting point with integrated security measures.

At the core of any crypto wallet is the private key, a unique string of characters that must remain confidential to prevent unauthorized access. Wallets employ various encryption methods to shield these keys, often using advanced algorithms that make brute-force attacks computationally infeasible. The distinction between hot and cold wallets plays a pivotal role here; hot wallets, connected to the internet for quick access, prioritize convenience but require layered security to mitigate online vulnerabilities. In contrast, cold wallets store keys offline, providing a physical barrier against remote hacks but demanding careful handling to avoid loss or theft.

Custodial versus non-custodial wallets present another layer of security consideration. Custodial options, managed by third parties like exchanges, offer recovery mechanisms and insurance against certain losses, appealing to newcomers who might forget passwords. However, this convenience comes with the risk of entrusting assets to an external entity, which could face breaches or operational failures. Non-custodial wallets empower users with full control, aligning with the decentralized ethos of cryptocurrency but placing the burden of security entirely on the individual.

The integration of multi-factor authentication has become a standard feature, adding barriers that require more than just a password for access. Biometric options, such as fingerprint or facial recognition, further personalize security, making it harder for imposters to gain entry. These advancements reflect a broader trend toward user-centric design, where security enhances rather than hinders the overall experience of managing digital assets.

Technological innovations bolstering wallet defenses

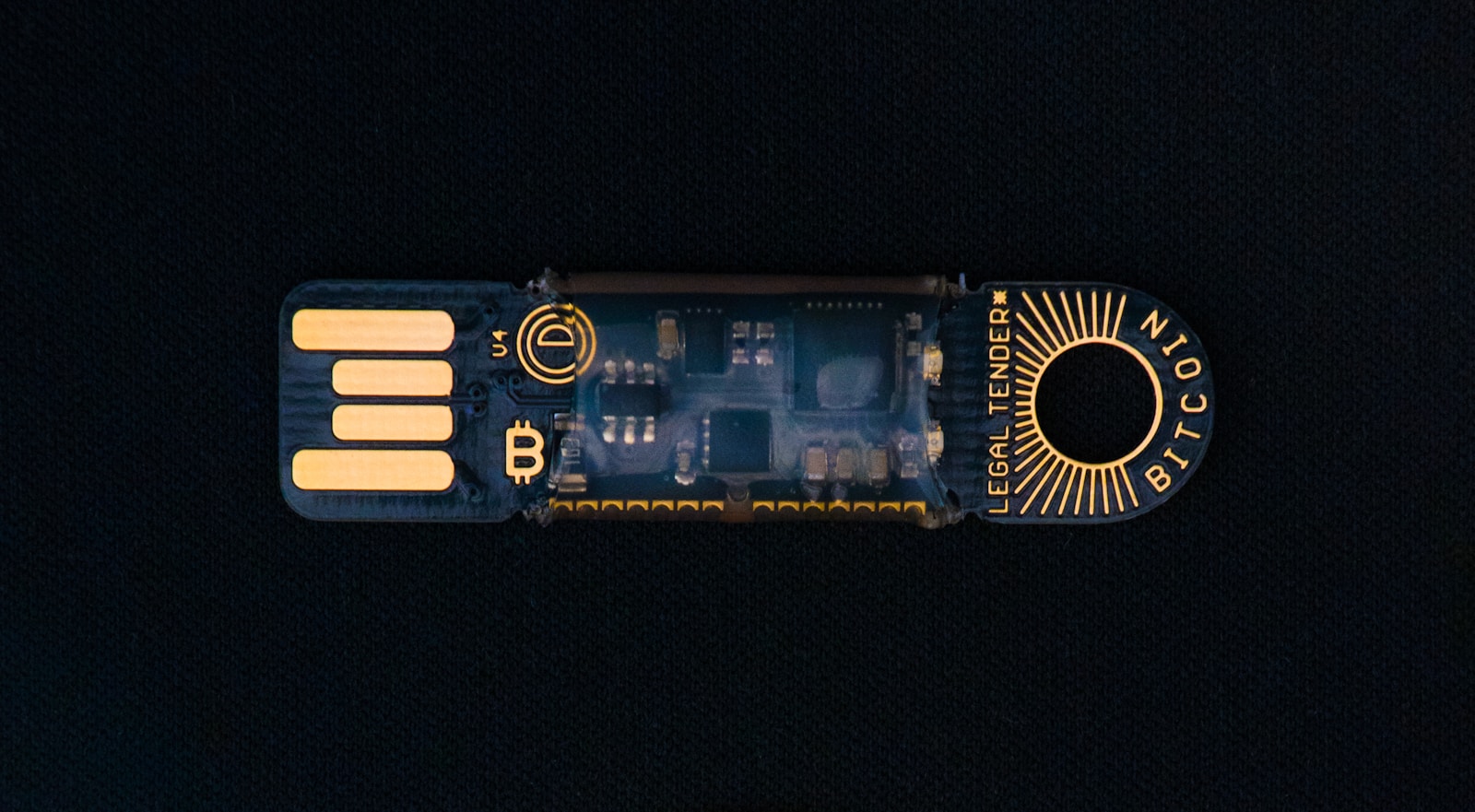

Recent years have seen a surge in innovative technologies aimed at fortifying crypto wallets against emerging threats. Hardware security modules, embedded in devices like ledger-style wallets, isolate sensitive operations from potentially compromised systems, ensuring that private keys never leave a secure environment. This hardware-based approach has proven effective against malware that targets software vulnerabilities, providing a tangible layer of protection for high-value holdings.

Multi-party computation is another breakthrough, allowing wallets to split private keys across multiple devices or parties without revealing the full key to any single entity. This method distributes risk, meaning that even if one component is compromised, the entire key remains secure. It’s particularly useful for collaborative scenarios, such as business accounts where multiple stakeholders need access without centralizing control. As adoption grows, this technology is democratizing secure crypto management for teams and organizations.

Air-gapping, a technique where wallets operate without any network connection, eliminates the possibility of remote attacks. Devices employing this method often use QR codes or physical data transfers for transactions, combining isolation with functionality. While not suitable for frequent traders, air-gapped wallets are ideal for long-term storage, offering peace of mind in an era of pervasive cyber threats. For enhanced management of your assets, consider exploring https://www.paypilot.org/crypto-exchange/ as a complementary tool.

Artificial intelligence is beginning to play a role in proactive security, with wallets incorporating AI-driven anomaly detection to flag unusual activity patterns. These systems can alert users to potential breaches in real-time, allowing for swift intervention. As AI evolves, it promises to make wallets not just reactive but predictive, anticipating threats based on behavioral data and global attack trends.

Quantum-resistant cryptography is on the horizon, addressing the future threat posed by quantum computers that could break current encryption standards. Wallets adopting post-quantum algorithms are future-proofing user assets, ensuring longevity in a field where technological leaps can render old safeguards obsolete. This forward-thinking approach underscores the industry’s commitment to staying ahead of potential disruptions.

Practical strategies for maximizing wallet safety

While technology provides the tools, user practices are equally vital in maintaining wallet security. Regularly updating wallet software ensures that the latest patches address known vulnerabilities, a simple habit that can prevent many common exploits. Users should also diversify their storage, spreading assets across multiple wallets to avoid putting all eggs in one basket. This strategy limits potential losses if one wallet is compromised.

Seed phrase management is a critical skill, involving the secure storage of recovery words in offline, tamper-proof locations. Avoiding digital copies and using metal engraving for durability can protect against physical damage or accidental deletion. Educating oneself on phishing tactics is essential, as social engineering remains a primary attack vector; verifying all communications and using official channels prevents falling for deceptive schemes.

Implementing spending limits and transaction confirmations adds another control layer, requiring explicit approval for large transfers. This feature is particularly useful in mobile wallets, where quick access might otherwise lead to hasty decisions. Combining it with time-delayed transactions gives users a window to detect and halt suspicious activity.

Regular security audits, either self-conducted or through professional services, help identify weaknesses in one’s setup. Keeping abreast of industry news and threat reports informs better decision-making, allowing users to adapt to new risks promptly. Ultimately, a proactive mindset transforms wallet security from a passive feature into an active defense strategy.

Balancing innovation with user responsibility

As crypto wallets continue to innovate, the balance between cutting-edge features and user responsibility remains delicate. The push for seamless integration with decentralized finance applications expands wallet utility but introduces new attack surfaces that must be carefully managed. Developers are responding by embedding security education within apps, guiding users through best practices during setup and usage.

The rise of social recovery mechanisms offers a middle ground for non-custodial wallets, allowing trusted contacts to assist in key recovery without compromising privacy. This community-based approach mitigates the fear of permanent loss, encouraging more people to embrace self-custody. However, it requires careful selection of trustees and clear protocols to avoid disputes or exploitation.

Regulatory developments are influencing wallet design, with some jurisdictions mandating certain security standards for consumer protection. This oversight can standardize best practices but may stifle innovation if too prescriptive. The challenge lies in fostering a regulatory environment that supports growth while ensuring baseline safeguards for all users.

In conclusion, the evolution of crypto wallet security reflects the maturation of the entire ecosystem, blending technological prowess with human-centric design. As threats grow more sophisticated, so too do the defenses, empowering users to engage confidently with digital assets. By staying informed and vigilant, individuals can harness these advancements to protect their financial future in this dynamic domain.