Maintaining your crypto assets without frequent selling can maximize gains by avoiding impulsive decisions during market dips. This approach relies on patience and confidence in the underlying technology and adoption trends. By keeping digital coins over extended periods, investors often benefit from compounding growth rather than short-term speculation.

An uncomplicated method for investment involves acquiring cryptocurrencies and resisting the urge to trade based on daily price movements. This steady accumulation creates a foundation for wealth building. For example, those who purchased Bitcoin years ago and refrained from selling have seen exponential returns compared to those attempting quick flips.

This plan focuses on minimizing emotional reactions and transaction fees while allowing time for projects to mature. Understanding that market volatility is normal helps maintain discipline. Holding tokens through various cycles increases the likelihood of capturing substantial upward trends triggered by broader adoption or technological breakthroughs.

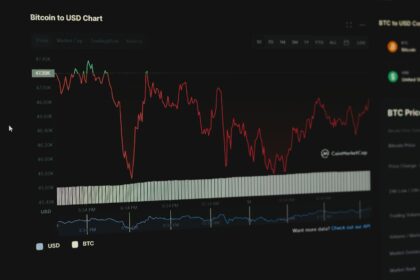

Crypto HODL strategy: long-term holding explained

The approach of maintaining assets over extended periods emphasizes patience and discipline rather than frequent trading or market timing. This method relies on the assumption that, despite volatility, the intrinsic value of certain digital currencies will appreciate significantly with time. Investors who adopt this approach prioritize endurance through price fluctuations and avoid impulsive reactions to short-term market movements.

Technically, this technique involves securing private keys and wallets to ensure asset safety while refraining from selling during transient dips. The simplicity of this method reduces transaction costs and exposure to market timing errors, which can erode overall returns. Many historical data analyses reveal that holders often outperform active traders across various cryptocurrency markets.

Key principles behind patient investment in digital assets

Central to this practice is the understanding of blockchain fundamentals and project viability. Successful outcomes typically stem from selecting tokens with robust development teams, clear use cases, and strong community support. For example, Bitcoin’s sustained growth since 2009 exemplifies how steadfast commitment can yield substantial profits despite multiple downturns.

Moreover, quantitative studies show that investors who resist selling during corrections benefit from compound gains when markets recover. A case study involving Ethereum holders between 2016 and 2021 demonstrated an average annualized return exceeding 100%, highlighting the power of perseverance combined with strategic asset selection.

- Reduced stress: Avoiding constant portfolio monitoring lowers emotional decision-making risks.

- Lower fees: Minimizing trades decreases cumulative transaction expenses.

- Diversification benefits: Spreading investments across multiple promising projects mitigates risks inherent in individual tokens.

A practical recommendation includes setting predefined intervals for portfolio reviews rather than reacting to daily price changes. Tools like hardware wallets or cold storage solutions enhance security for immobile assets. Additionally, automated alerts can help track significant milestones without encouraging knee-jerk reactions.

This systematic waiting methodology aligns well with emerging institutional frameworks supporting blockchain adoption worldwide. Patience combined with informed decisions about asset quality forms a foundational pillar for anyone considering entry into decentralized finance ecosystems or similar investment environments.

Choosing Assets for a HODL Approach

Selecting the right tokens for a prolonged investment requires prioritizing projects with proven fundamentals and sustainable development. Consider assets that demonstrate consistent network activity, strong developer communities, and clear use cases that extend beyond speculative trading. For example, Bitcoin’s established dominance as a decentralized store of value makes it a frequent choice among those seeking stability in their portfolios over extended periods.

Analyzing market capitalization alongside liquidity provides insight into an asset’s resilience during market fluctuations. Large-cap tokens tend to exhibit lower volatility compared to smaller, less liquid alternatives. However, diversification across various categories–such as smart contract platforms, decentralized finance protocols, and infrastructure tokens–can balance potential growth with risk management within your accumulation plan.

Technical Metrics and Project Viability

Examine on-chain data like transaction volume, active addresses, and staking participation rates to gauge genuine user adoption rather than hype-driven interest. Projects with increasing daily active users and sustained network throughput often indicate robustness suitable for extended retention. Additionally, evaluating tokenomics–including supply distribution models and inflation rates–helps determine long-term scarcity and value appreciation potential.

Case studies reveal that assets implementing deflationary mechanisms or regular protocol upgrades tend to maintain investor confidence better over time. For instance, Ethereum’s transition towards proof-of-stake aims to reduce issuance and enhance network efficiency, factors influencing its attractiveness for patient investors focused on gradual capital appreciation.

- Security audits: Confirm whether independent firms have verified the codebase to minimize vulnerabilities.

- Roadmap transparency: Clear milestones suggest ongoing commitment from development teams.

- Ecosystem partnerships: Collaborations with reputable entities can accelerate adoption and utility.

Simplicity in portfolio composition aids in reducing oversight risks. Concentrating on fewer well-understood assets rather than numerous speculative ones allows investors to monitor developments effectively without being overwhelmed by complexity or noise inherent in the market cycles.

Ultimately, patience combined with informed selection forms the foundation of this accumulation approach. By anchoring decisions in technical data and real-world application scenarios rather than short-lived trends, individuals position themselves to benefit from natural maturation phases common in blockchain projects over multi-year horizons.

Managing Risks During Volatility

Maintaining a calm and consistent approach to your digital asset investment can significantly reduce exposure to market turbulence. One effective method involves setting clear entry points and predetermined exit thresholds based on thorough technical analysis rather than reacting impulsively to price swings. This disciplined course helps preserve capital by avoiding panic selling during downturns or overenthusiastic buying during spikes.

Another key element is diversification across different tokens and sectors within the blockchain ecosystem. By distributing holdings, investors minimize the impact of a single asset’s volatility on the overall portfolio. For instance, blending assets with varying correlation patterns–such as mixing stablecoins, utility tokens, and platform coins–offers a buffer against sudden market shifts while maintaining growth potential.

Risk Management Techniques for Sustained Investment

Implementing automated tools like stop-loss orders or limit buys can add an extra layer of control over price fluctuations. These mechanisms trigger predefined actions without emotional interference, which is critical during sharp movements that occur within minutes or hours. For example, using trailing stops allows locking in profits while still giving room for upside momentum.

Patience plays a vital role in retaining gains when markets experience sharp corrections. Historical data indicates that major cryptocurrencies often recover after dips caused by macroeconomic events or regulatory announcements. Adopting a straightforward buy-and-hold mindset supported by periodic portfolio reviews enables investors to stay aligned with their financial goals despite short-term noise.

Tax Implications of HODLing

When assets are retained over extended periods without frequent transactions, tax treatment often favors the investor through reduced rates on gains. Understanding how government agencies classify and tax these profits can significantly impact the overall return from a patient accumulation approach. For example, in many jurisdictions, profits realized after holding an asset for more than one year qualify for lower capital gains rates compared to short-term sales.

Many participants adopt this retention method to benefit from simplified reporting and potentially advantageous taxation schedules. However, it is critical to track acquisition costs and dates accurately since taxable events occur only upon disposition. This means that no taxes are levied while simply maintaining ownership, but detailed records become essential once a sale or exchange happens.

How Tax Authorities View Extended Asset Retention

Tax systems typically differentiate between short-term and extended periods of property possession. A common structure applies ordinary income rates if assets change hands within twelve months of purchase, whereas holding beyond that timeframe qualifies for preferential capital gains treatment. This distinction encourages investors to maintain positions patiently rather than engage in rapid trading.

For instance, in the United States, assets sold after more than 365 days attract long-term capital gains tax rates ranging from 0% to 20%, depending on income brackets–significantly lower than ordinary income taxes that can exceed 37%. Such benefits underscore why many elect to keep their digital holdings untouched over prolonged durations.

Record-Keeping and Reporting Requirements

- Acquisition Cost: Documenting original purchase price including fees helps calculate accurate gain or loss upon disposal.

- Date of Purchase: Establishes eligibility for favorable tax brackets by proving duration held.

- Date of Sale/Exchange: Marks taxable event triggering declaration obligations.

Failure to maintain comprehensive logs risks inaccurate filings and possible penalties. Employing software tools designed for portfolio tracking can simplify compliance by automatically aggregating transaction data across multiple platforms.

Tax Treatment Examples Based on Holding Patterns

Strategic Considerations for Patient Investors

An accumulation approach requires disciplined restraint but offers potential fiscal advantages through deferred taxation and possibly lower effective rates. Additionally, some countries provide exemptions or reduced taxes on holdings exceeding certain durations, further incentivizing patience. Consulting local regulations is advisable since rules vary widely worldwide and occasional legislative updates may affect outcomes.

The use of wallets with transparent transaction histories aids demonstration of timelines during audits or inquiries by authorities. Moreover, integrating professional advice early prevents costly mistakes associated with complex tax codes applied to emerging asset classes. Hence, adopting a methodical retention plan aligned with regulatory frameworks enhances both compliance and profit maximization prospects over time.

Timing exit from investments

Patience remains the most effective tool when deciding the moment to liquidate digital asset positions. Statistical trends reveal that impulsive sales during market volatility often result in missed gains, while those who maintain their assets for extended periods typically experience superior returns. A simple approach is to set predefined thresholds based on technical indicators such as moving averages or on-chain metrics like transaction volume spikes, which can signal optimal exit points without emotional bias.

Maintaining a disciplined framework grounded in steady accumulation and retention enhances portfolio resilience against short-term fluctuations. For example, investors adhering to a buy-and-hold mentality during the 2017–2021 bull run benefited significantly despite intermittent corrections. This approach complements algorithmic trading models that factor in macroeconomic variables, offering a hybrid method that balances opportunity capture with risk mitigation.

Key insights for future developments

- Automated triggers: Increasingly sophisticated smart contracts will enable programmable exit strategies aligned with individual risk profiles, reducing human error.

- Sentiment analysis integration: Advanced AI tools capable of parsing social media and news trends could refine timing decisions by detecting shifts before price movements occur.

- Diversification across protocols: Allocating assets across multiple blockchain ecosystems may allow staggered exits tailored to each network’s unique cycles and adoption curves.

- Regulatory impact monitoring: Keeping abreast of compliance changes ensures timely adjustments, preventing forced liquidations or penalties triggered by policy shifts.

An investment approach centered on sustained retention requires balancing technical signals with emotional discipline. By harnessing emerging technologies alongside time-tested principles of endurance within decentralized finance markets, participants can optimize withdrawal timing to maximize value extraction over prolonged horizons.

This patient methodology fosters confidence and promotes steadiness amid market noise, ultimately supporting more informed decision-making processes that align with evolving blockchain innovations and financial ecosystems.