Achieving permanent settlement requires mechanisms that guarantee the certainty of each operation recorded on the ledger. Without definitive closure, any recorded transfer could be reversed or altered, undermining trust and security. Networks employ consensus protocols designed to ensure that once a change is accepted, it becomes immutable and cannot be undone.

Security in distributed ledgers depends heavily on the assurance that data entries reach an unchangeable state. This level of assurance protects users from double-spending and fraud by making every validated action final and beyond dispute. Understanding how this irreversible process works helps participants assess risk and confidently engage in asset exchanges.

The process of reaching conclusive verification differs among systems, but its goal remains consistent: achieving a state where records are permanently fixed. This guarantees participants clarity about the status of their operations, enabling seamless integration with real-world applications such as payments or contract executions. Recognizing these principles allows for better design and use of decentralized technologies with strong guarantees of settlement certainty.

Blockchain finality: irreversible transaction confirmation

Ensuring that a transfer of digital assets becomes permanent and cannot be undone is fundamental for trust in decentralized ledgers. This concept, known as finality, guarantees that once an operation is included in the ledger, it achieves a state of certainty beyond any practical reversal. Achieving such conclusive validation requires robust consensus mechanisms and network-wide agreement, which together create a secure environment resistant to fraud or rollback.

The process involves multiple layers of checks that confirm the inclusion of data blocks into the chain. Once these blocks have been validated and accepted by the majority of participants, their contents become part of an immutable record. This permanence ensures that users can rely on the system with confidence, knowing that previous updates will not be changed or erased.

Technical foundations behind conclusive ledger states

Distributed ledgers rely on different protocols to achieve definitive acceptance of entries. For example, proof-of-work systems like Bitcoin depend on cumulative computational effort, where deeper confirmations–meaning more subsequent blocks added after a given one–increase assurance against reversals. Typically, waiting for six confirmations provides sufficient security to consider a payment settled permanently.

In contrast, some proof-of-stake networks implement explicit checkpoints or finality gadgets that allow immediate recognition of finalized records without requiring extended wait times. Protocols such as Ethereum 2.0’s Casper introduce validator committees that finalize blocks through voting processes, drastically reducing latency while maintaining high security standards.

- Cumulative difficulty: Longer chains represent greater work and more reliable history.

- Validator consensus: Agreement among trusted parties accelerates certainty.

- Checkpointing: Periodic anchors establish undeniable milestones within the ledger.

This diversity in design illustrates how achieving permanent settlement depends heavily on underlying consensus algorithms and their approach to handling potential forks or conflicting states within the network.

Real-world implications and examples

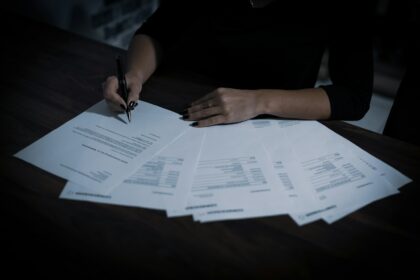

A merchant accepting cryptocurrency payments needs to understand when funds become irrevocably credited. Relying on instant notifications without considering confirmation depth exposes them to risks such as double spending attacks or reorganizations caused by competing versions of the ledger history. Waiting for adequate depth reduces uncertainty and prevents financial loss caused by premature acceptance.

A practical illustration can be found in decentralized finance (DeFi) applications where smart contract executions depend on guaranteed permanence before triggering further actions like asset swaps or loan disbursements. Here, concluding operations only after reaching specified levels of network agreement avoids cascading errors resulting from potential rollbacks.

The role of security models in guaranteeing irreversibility

The robustness of irreversible commitment depends on assumptions about adversarial capabilities and economic incentives embedded within each system’s architecture. Proof-of-work relies on computational cost barriers making attempts at rewriting history economically unfeasible. Proof-of-stake shifts this model toward economic slashing penalties deterring validators from endorsing contradictory states.

This dual approach emphasizes why no single technique suits all environments; instead, careful balancing between speed, safety, and resource consumption must guide protocol selection tailored to specific application needs or threat models.

Navigating uncertainties: probabilistic versus deterministic settlement

Certain systems provide probabilistic assurance where risk diminishes exponentially with additional validations but never fully reaches zero–typical in Nakamoto consensus-based chains where forks are possible but increasingly unlikely over time. Others adopt deterministic schemes offering absolute confirmation once particular conditions are met–common in Byzantine fault tolerant protocols utilized by permissioned networks.

This distinction affects user experience profoundly: probabilistic schemes require patience during initial waiting periods while deterministic ones enable near-instantaneous trustworthiness at the cost of stricter participant control mechanisms.

Conclusion: mastering permanence through informed application design

The guarantee that digital updates become fixed without possibility of rollback forms the backbone for trustworthy decentralized systems supporting financial activities worldwide. Understanding how different architectures achieve this trust allows developers and users alike to optimize workflows according to their tolerance for delay versus need for certainty and protection against fraud.

Selecting appropriate thresholds for validating new entries according to context ensures operational reliability while maintaining network efficiency–a foundational principle underpinning scalable distributed technology ecosystems today and tomorrow.

Types of blockchain finality

To achieve permanent settlement in decentralized ledgers, different mechanisms provide certainty that a recorded operation will not be altered or reversed. These methods vary in the degree and timing of achieving definitive state changes within the chain’s data structure, each addressing the trade-off between speed and security differently. Understanding these types helps clarify how various protocols ensure that an entry becomes lasting and trustworthy.

Probabilistic settlement is common in proof-of-work systems like Bitcoin. Here, an operation gains increasing assurance as more blocks are appended after it, reducing the chance of reorganization. The deeper a record lies beneath subsequent layers, the higher the confidence that it won’t be undone. While not instant, this approach allows participants to estimate when a ledger update can be considered effectively permanent.

1. Probabilistic finality

This model relies on cumulative work or stake to gradually solidify entries. Confirmation is never absolute at a single point but improves exponentially with each additional block added atop the relevant one. For example, waiting for six confirmations in Bitcoin is standard practice before considering funds settled with high certainty. However, theoretically, reorganization remains possible until infinite depth is achieved.

2. Deterministic finality

In contrast, deterministic approaches finalize states immediately or within fixed steps without probabilistic uncertainty. Protocols utilizing Byzantine Fault Tolerant consensus algorithms such as Tendermint guarantee that once a decision passes voting thresholds among validators, it becomes permanent and unalterable by network forks or reorganizations. This provides near-instant certainty about ledger updates’ permanence.

3. Economic finality

Certain consensus mechanisms leverage economic incentives and penalties to enforce permanence indirectly. For example, proof-of-stake chains may slash validators who attempt to revert confirmed records, deterring malicious behavior through financial loss risks rather than computational difficulty alone. This encourages participants to accept entries as irreversible once finalized economically.

4. Hybrid finality models

Some networks combine probabilistic and deterministic elements to optimize confirmation speed while maintaining high security guarantees. For instance, Ethereum’s transition involves fast block production with eventual checkpointing via consensus layers that grant deterministic settlement points ensuring permanent state transitions beyond probabilistic assurances given by block additions.

5. Checkpoint-based finality

A defined checkpoint mechanism periodically marks specific ledger states as irrevocable by protocol rules or validator agreement. Such checkpoints act as anchors beyond which no rollback occurs even if temporary forks arise earlier in history. This method offers clear milestones for users requiring quick certainty over operations without relying solely on continuous chain growth.

6. Instantaneous finality solutions

Certain permissioned ledgers utilize trusted hardware or centralized validation frameworks enabling immediate acceptance of new records as permanent upon endorsement by authoritative nodes or committees. While less decentralized, this approach suits environments prioritizing rapid settlement with strong guarantees over public trust minimization.

Finality in Proof-of-Work Chains

The settlement of data entries on proof-of-work (PoW) ledgers gains reliability through the accumulation of computational effort, which significantly enhances the security and permanence of recorded states. Each newly appended block increases the certainty that prior updates are permanent and cannot be altered without enormous expenditure of resources. This progressive reinforcement means that after a sufficient number of confirmations, the ledger state can be considered stable and immutable for practical purposes.

In PoW systems, finality is probabilistic rather than absolute at first; however, with each additional linked block, the probability that earlier changes can be reverted diminishes exponentially. For instance, Bitcoin’s protocol suggests waiting for six subsequent blocks–approximately one hour–to reach a level of assurance suitable for high-value settlements. This approach balances speed and trust by leveraging cryptographic difficulty to secure data against reorganizations or double-spending attempts.

Security and Certainty Mechanisms

The core mechanism securing PoW chains lies in the energy-intensive puzzle solving that validates new blocks. The costliness of this process deters adversaries from attempting to rewrite history since overriding existing records requires re-mining not only the targeted block but all successors faster than honest participants can extend the chain. Consequently, once a record has been embedded under many layers of proof-of-work, its status approaches permanence, providing users with growing confidence in its authenticity.

A real-world example is Ethereum’s transition before implementing finality gadgets like checkpointing protocols: while awaiting consensus on transaction settlement, participants relied solely on cumulative mining difficulty to judge when data updates were effectively irreversible. Despite occasional forks or chain reorganizations, extended branch depth generally ensured long-term stability. Users could thus treat these settled points as trustworthy milestones essential for applications demanding high integrity such as decentralized finance or asset custody.

Finality in Proof-of-Stake Chains

Ensuring security and permanent settlement is fundamental for proof-of-stake (PoS) networks, where transaction approval becomes final only after a defined process. Unlike traditional consensus methods, PoS relies on validators staking tokens to participate in block validation, which increases the cost of attempting to revert data entries. This mechanism allows for a quicker and energy-efficient path to achieving definitive ledger states that users can trust as permanent.

The concept of conclusive ledger state confirmation in PoS systems involves mechanisms designed to prevent reorganization or rollback of records once they are considered final. For example, Ethereum’s Beacon Chain uses Casper FFG (Friendly Finality Gadget), which introduces checkpoints finalized through validator votes. Once a checkpoint is finalized, any conflicting history prior to it becomes practically impossible to alter without incurring significant economic penalties, thus enhancing overall network robustness.

Understanding Settlement and Assurance in PoS Networks

In practice, settlements on PoS platforms become unalterable after a series of voting rounds by staked participants. Validators cast votes on blocks during epochs–fixed intervals of time–and when supermajorities (often two-thirds or more) agree on a block’s validity, that block attains permanent status. This process mitigates risks such as double-spending and chain splits by providing strong guarantees that confirmed states will remain unchanged.

A practical illustration comes from Cosmos SDK-based chains implementing Tendermint consensus, where each block undergoes three phases: proposal, prevote, and precommit. When more than two-thirds of validators precommit to a block, the system achieves an explicit point of settlement considered irreversible barring catastrophic failures. Such design choices prioritize speedy yet reliable ledger updates suitable for decentralized finance applications requiring timely asset transfers with guaranteed immutability.

Security models in PoS finalization hinge on economic disincentives paired with cryptographic proofs ensuring validator honesty. Slashing conditions penalize nodes acting against protocol rules–attempting to rewrite history or equivocate–by confiscating their staked funds. This creates an environment where reversing settled entries demands prohibitive costs outweighing potential rewards, securing the ledger’s integrity over extended periods.

It is essential for developers and users alike to recognize how varying finalization timings affect usability and trustworthiness across different networks. While some ecosystems opt for near-instantaneous settlement through aggressive checkpointing protocols, others balance latency with decentralization by extending finality windows. Understanding these trade-offs helps participants select platforms aligning with their operational requirements for transaction permanence and safety assurance.

Measuring Transaction Irreversibility

To achieve a reliable degree of certainty that an entry on a distributed ledger is no longer subject to alteration, one must evaluate the probability of it being reversed or replaced. This assessment hinges on factors such as the consensus mechanism and network security parameters. For example, in proof-of-work systems, the depth of block confirmations directly influences settlement confidence: each additional block added atop a record exponentially decreases the likelihood of rollback.

Quantifying this assurance involves probabilistic models and empirical data analysis. Take Bitcoin as an illustration–after six subsequent blocks have been appended, the chance that a payment will be invalidated falls below 0.1%. This benchmark has become widely accepted for practical finality, ensuring users can proceed with confidence in transaction settlement.

Factors Affecting Settlement Certainty

The architecture behind distributed ledgers plays a pivotal role in determining how quickly and securely entries reach immutable status. In delegated proof-of-stake protocols, for instance, deterministic finalization can be achieved within seconds due to pre-committed validator votes, contrasting with probabilistic confirmation in mining-based chains. Evaluating metrics like block time intervals, validator count, and fork resistance provides clearer insight into system robustness.

- Network Security: Greater hashing power or stake concentration discourages malicious attempts to reorganize past records.

- Consensus Algorithm: Byzantine fault-tolerant mechanisms often yield faster irreversible states compared to open competition models.

- Confirmation Depth: The number of subsequent ledger updates after an entry affects its permanence probability.

This multifactorial approach enables analysts to assign numerical thresholds reflecting acceptable risk levels for reversal under specific operational contexts.

Practical Implications for Users and Developers

Understanding when digital asset movements become permanently embedded empowers stakeholders to make informed decisions regarding trust and usability. Merchants accepting payments can mitigate fraud risks by waiting for adequate ledger stabilization before finalizing goods shipment. Similarly, developers designing smart contracts must account for temporal windows where state changes remain tentative.

A case study from Ethereum reveals how its shift toward proof-of-stake consensus introduces epoch-based checkpoints that expedite irreversible commitments, reducing reliance on long confirmation waits prevalent in earlier models. This evolution exemplifies how protocol enhancements drive improved settlement guarantees while balancing throughput and latency demands.

Tools and Techniques for Monitoring Ledger Stability

Real-time analytics platforms track various indicators such as chain reorganizations, orphaned blocks, and validator behavior to provide transparency about current ledger reliability levels. These tools often visualize confirmation progressions and alert users when entries cross established thresholds signifying effective immutability.

- Block Explorer Metrics: Display cumulative confirmations alongside timestamps for user verification.

- Statistical Risk Models: Calculate reversal probabilities based on historical network performance data.

- Security Audits: Assess protocol resilience against adversarial conditions impacting settlement finality.

The integration of these resources supports enhanced operational security by enabling prompt reactions to anomalies that might threaten permanent record settlement.

Synthesis: Balancing Speed and Assurance in Confirmation Processes

The trade-off between rapid processing times and high certainty of permanence remains central when gauging transaction solidity across different frameworks. While some networks prioritize swift inclusion with eventual consistency, others emphasize immediate irreversibility via strict consensus rules. Selecting appropriate confirmation strategies depends heavily on application requirements–be it micro-payments demanding quick turnaround or large-value transfers necessitating maximal safety assurances.

An informed balance between these elements underpins robust financial operations leveraging decentralized ledgers while maintaining user trust through verifiable permanence assurances.

Handling chain reorganizations: securing settlement and certainty

The key to managing reorgs lies in recognizing that only after a sufficient number of subsequent blocks does a ledger entry become permanent. This gradual accumulation ensures the settlement of operations with high certainty, transforming tentative data into dependable records. For example, in proof-of-work systems like Bitcoin, waiting for six confirmations is a practical rule to treat an update as finalized and durable.

Mechanisms designed to mitigate rollback risks focus on increasing the cost and complexity of reversing states, thus reinforcing the finality of ledger updates. Consensus models with deterministic finalization, such as Byzantine Fault Tolerant protocols employed by some modern networks, reduce ambiguity by enabling near-instant recognition of irreversible entries. This shift profoundly impacts user trust and system reliability.

Technical insights and future implications

- Probabilistic vs deterministic approaches: Probabilistic settlement requires cautious delay before declaring permanence, while deterministic techniques offer immediate assurance but often demand more sophisticated validator coordination.

- Economic incentives: Proper alignment ensures validators resist reorganizing chains beyond certain depths, preserving transaction integrity and minimizing double-spend vulnerabilities.

- User experience considerations: Wallets and applications should transparently communicate confirmation depth to balance speed with safety, adapting dynamically based on network conditions.

- Emerging hybrid solutions: Layer-two protocols and cross-chain bridges increasingly depend on robust settlement guarantees from underlying ledgers to maintain overall ecosystem security.

Evolving architectures will likely emphasize stronger guarantees against rollbacks without compromising throughput or decentralization. Developers must integrate flexible strategies that adjust confirmation thresholds contextually–considering transaction value, application risk tolerance, and network health–to provide users with both speed and assurance.

This layered understanding empowers participants–from everyday users verifying simple payments to enterprises executing complex contracts–to navigate uncertainties inherent in distributed ledgers. By framing reorganization handling as a dynamic equilibrium between temporary fluidity and eventual permanence, the community advances toward systems where trust is mathematically underpinned rather than assumed.