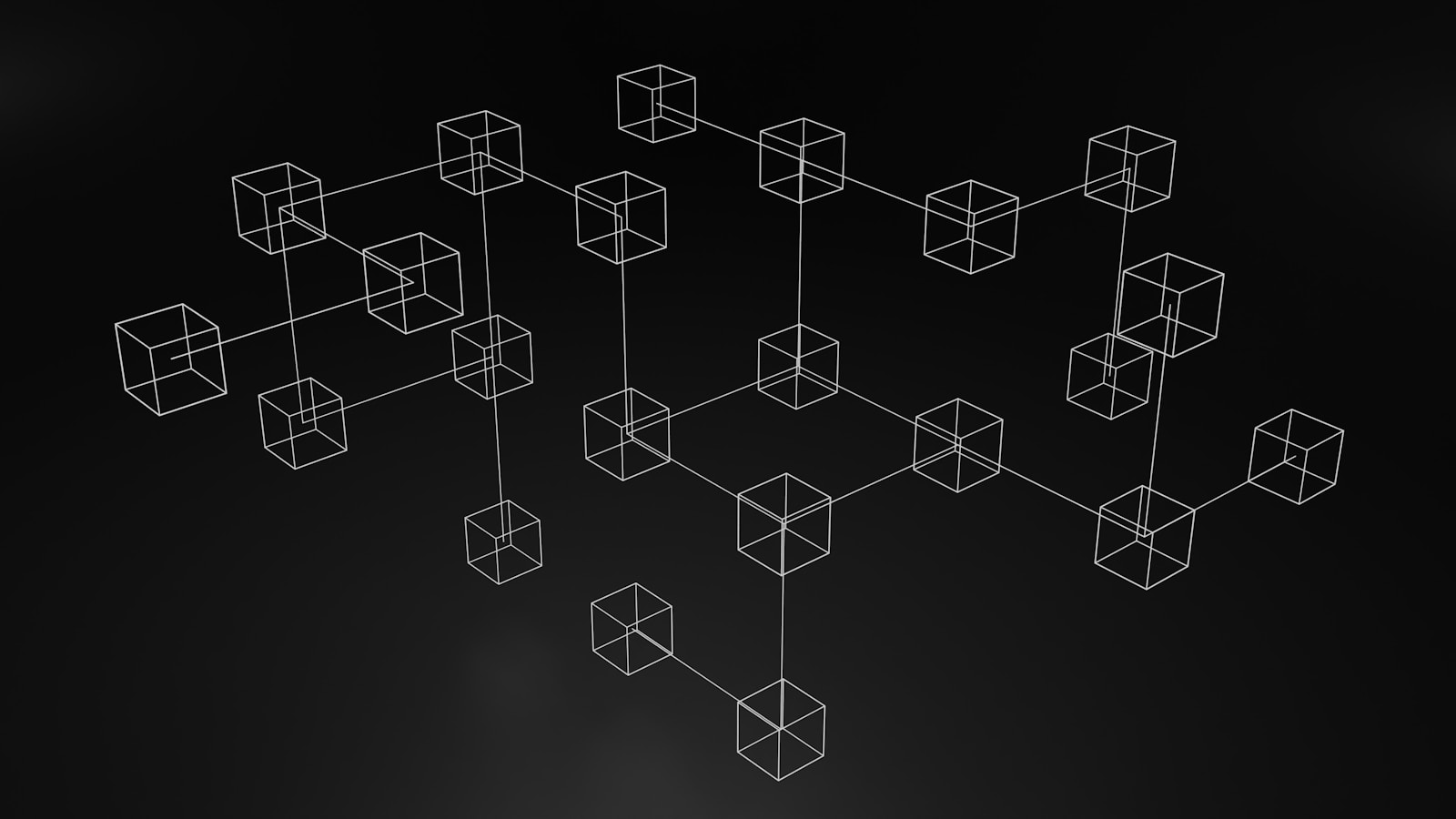

A distributed ledger acts as a shared record of transactions maintained across multiple locations without relying on a central authority. This setup ensures transparency and security by allowing participants to verify entries independently. Imagine it as a constantly updated notebook that everyone involved can see and trust.

Grasping how this system functions becomes straightforward when you break it down into simple parts. Each new record, or block, links to the previous one, creating a chain that prevents alteration without detection. This structure guarantees data integrity while enabling seamless collaboration among users.

To build confidence in using such systems, focus on real-life examples like tracking shipments or recording financial exchanges. By observing how information is securely shared and confirmed by multiple parties, you develop an intuitive understanding of why this approach matters and how it improves trust.

Blockchain explained: technology made simple for everyone

Understanding the distributed ledger system requires recognizing how data is stored across multiple nodes, creating a secure and tamper-resistant record. Each participant holds a synchronized copy of this ledger, which ensures transparency and integrity without relying on a central authority. This design makes verifying transactions straightforward and trustworthy, as any attempt to alter data would need consensus from the majority.

The concept can be illustrated with shared spreadsheets where multiple users update information simultaneously but with cryptographic safeguards preventing unauthorized changes. Such a mechanism enhances trust among parties who may not fully trust each other, enabling direct interactions without intermediaries. This decentralized approach reduces single points of failure common in traditional databases.

Core Components and Their Roles

At its heart, the system consists of blocks that bundle transaction data linked through cryptographic hashes forming a continuous chain. Each block contains:

- Timestamp: Records the exact creation time.

- Transaction details: Includes sender, receiver, amount, or asset data.

- Hash pointer: Links to the previous block’s hash ensuring immutability.

This structure guarantees that altering one block invalidates all subsequent ones, alerting participants to inconsistencies immediately. Consensus algorithms such as Proof of Work or Proof of Stake further validate new entries by requiring computational effort or stake-based validation respectively.

A practical example is supply chain management where stakeholders track products at every step transparently. By recording each transfer on this distributed register, companies reduce fraud risks and improve accountability while customers gain visibility into product origins.

The accessibility of this system means that anyone interested can verify operations independently using simple tools or applications designed for interaction with these ledgers. Educational platforms often include interactive simulators demonstrating how entries propagate through networks and how consensus agreements occur step-by-step.

This methodical approach helps newcomers build confidence by linking abstract concepts to tangible examples like digital voting systems or peer-to-peer financial exchanges. Understanding these mechanisms empowers users beyond technical backgrounds to appreciate the innovation’s potential impact across multiple sectors including finance, healthcare, logistics, and governance.

How blockchain stores data

The core principle behind this system’s data storage lies in its distributed ledger, which records information across multiple nodes simultaneously. Each piece of data is grouped into blocks that are cryptographically linked, ensuring integrity and immutability. This design eliminates the need for a central authority by allowing numerous participants to maintain and verify the ledger independently.

Understanding the process begins with recognizing that every new block contains a reference to the previous one via a unique hash value. This chaining mechanism makes retroactive alteration practically impossible without detection, as altering one block would require recalculating all subsequent hashes across the network. Such resilience forms the backbone of trustless record-keeping systems.

Data structuring within blocks

Each block typically includes three main components:

- Header: Contains metadata such as timestamp, nonce, and the previous block’s hash.

- Transaction list: A collection of verified transactions or data entries recorded during a specific period.

- Merkle root: A single hash representing all transactions inside the block, enabling efficient verification.

This hierarchical arrangement allows participants to verify individual transactions without downloading the entire dataset. For instance, simplified payment verification (SPV) wallets rely on Merkle proofs to confirm payments securely with minimal data load.

The ledger operates across numerous geographically dispersed computers called nodes, each maintaining an identical copy. When a new transaction is broadcasted, nodes validate it using consensus algorithms like Proof of Work or Proof of Stake before adding it to their local ledgers. This decentralized validation process prevents fraudulent entries and double-spending attacks by requiring majority agreement among participants.

A practical example can be found in supply chain management applications where companies record product provenance on these ledgers. As goods move through various stages–manufacturing, shipping, retail–the corresponding data blocks update transparently and immutably. This approach enhances traceability and accountability without exposing sensitive internal databases to competitors or unauthorized parties.

This architectural framework offers robust security guarantees while maintaining openness and transparency. By storing data in an interconnected chain validated collectively rather than centrally controlled repositories, it provides a reliable alternative for recording critical information across diverse industries including finance, healthcare, and logistics.

Decentralization Benefits and Risks

Decentralized systems distribute control across multiple participants, reducing reliance on a single authority. This structure enhances transparency and security by making data immutable and resistant to censorship or manipulation. For example, in distributed ledgers, every participant holds a copy of the transaction history, which simplifies verification processes and mitigates fraud risks. Such an arrangement also improves fault tolerance, as no single point of failure can disrupt the entire network’s operation.

However, decentralization is not without drawbacks. The absence of centralized control can slow down decision-making and protocol upgrades since changes require consensus from a diverse set of stakeholders. This was evident in cases like Ethereum’s hard forks, where community disagreements delayed network improvements. Additionally, scalability remains a challenge; distributed networks often face performance bottlenecks compared to centralized alternatives due to the overhead of maintaining consensus among nodes.

Understanding Trade-offs in Distributed Architectures

The distributed nature encourages resilience but introduces complexity in governance and resource management. Nodes must coordinate securely while handling potentially conflicting interests, which complicates system maintenance. An illustrative case is the Bitcoin network’s mining centralization concerns: although designed to be decentralized, mining power has concentrated among few large pools, affecting true distribution levels and raising questions about vulnerability to collusion.

On the other hand, decentralization fosters inclusivity by enabling permissionless participation without requiring trust in intermediaries. This democratizes access to financial services and data integrity assurances globally. Educational initiatives that break down these concepts into relatable analogies–such as comparing ledger copies to shared notebooks checked by many people–help build confidence and facilitate deeper understanding for newcomers exploring this innovative paradigm.

Using blockchain for payments

Adopting a distributed ledger system significantly enhances the security and transparency of payment processes. This approach eliminates the need for intermediaries, allowing direct peer-to-peer transactions with reduced fees and faster settlement times. For instance, cross-border transfers that traditionally require days can now be completed within minutes by utilizing such networks.

The core principle behind this method is a decentralized database that records each transaction in an immutable manner. Every participant in the network holds a synchronized copy of this ledger, ensuring consistency and preventing unauthorized alterations. This structure fosters trust without relying on central authorities or third parties.

How decentralized ledgers transform payment systems

One key advantage is the enhanced resilience against fraud and errors. Since every transaction must be validated by multiple nodes before being added to the ledger, malicious attempts to alter data become impractical. For example, Ripple’s protocol leverages consensus algorithms to verify payments rapidly while maintaining security, demonstrating effective real-world application.

Moreover, smart contracts automate conditional payments based on predefined rules embedded in the network’s code. This feature allows businesses to implement escrow services or subscription models without manual oversight, streamlining operations and reducing administrative overhead.

- Lower transaction costs: Traditional payment gateways charge fees up to 3%, whereas decentralized networks typically operate at fractions of a percent.

- Speed: Settlements occur almost instantly compared to standard bank processing times ranging from hours to days.

- Transparency: All participants can audit transaction histories openly, promoting accountability.

The ease of integration also encourages adoption across various industries. Retailers can accept global payments without dealing with currency conversions manually because tokenized assets or cryptocurrencies enable seamless value exchange worldwide. Additionally, mobile applications built on these networks provide user-friendly interfaces that make sending funds straightforward even for newcomers.

A practical example is how remittance services utilize this infrastructure to send money home quickly and cheaply. Users initiate transfers via smartphone apps connected directly to distributed ledgers, bypassing traditional agents who often charge high commissions. This approach benefits migrant workers by increasing the amount received by their families substantially.

Conclusion: Practical Smart Contract Applications and Future Potential

Smart contracts operate as self-executing agreements embedded within a distributed ledger, removing intermediaries and enabling trustless transactions with transparency accessible to everyone. By automating complex workflows – such as supply chain tracking, decentralized finance protocols, and digital identity verification – these programmable agreements simplify interactions that traditionally required manual oversight.

The integration of immutable records stored across multiple nodes ensures data integrity and resilience against tampering. This foundational attribute creates new possibilities for sectors like insurance claims processing or real estate transfers, where conditional triggers execute payments or ownership changes instantly once predefined criteria are met. Such implementations reduce friction, cut costs, and accelerate processes while maintaining auditability.

- Decentralized Finance (DeFi): Lending platforms leverage smart contracts to automatically calculate interest rates and liquidate collateral without human intervention.

- Supply Chain Management: Real-time updates on product provenance become verifiable entries in the shared ledger, enhancing accountability.

- Legal Agreements: Automated escrow services enforce contract terms securely, minimizing disputes through clear code logic.

Looking ahead, advancements in interoperability between various distributed ledgers will foster more seamless cross-platform contract execution. Layer-2 solutions aimed at scaling transactional throughput promise to expand practical adoption by reducing latency and fees. Moreover, integrating oracles that feed trusted external data broadens smart contracts’ capability to interact dynamically with real-world conditions.

Understanding these evolving mechanics equips users at all levels to harness programmable trust effectively while appreciating inherent risks like coding vulnerabilities or governance challenges. As the ledger infrastructure matures into an accessible framework for automated agreements, its utility is poised to extend deeply into everyday applications–transforming how value exchanges unfold globally with precision and inclusivity.